This post is an attempt to introduce the idea of the long tail to more people. (And, selfishly, to clarify my own understanding in the process.) Note that I have no hard data here, and am not attempting to be rigorous – this is a qualitative introduction only. I first came across the idea in Chris Anderson’s Wired article – see his website for a much deeper discussion with more insight into real-world numbers.

In a nutshell.

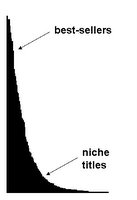

I think it’s easiest to start with an example. Let’s imagine a graph of the number of books sold by your neighborhood bookstore. (For example, Kepler’s, in front of which I’m currently writing.) Draw a vertical bar for each title, with the height of the bar determined by the number of copies of that title sold each month. Sort the bars from tallest to shortest, so the best-sellers are on the left, and the niche titles on the right. The graph will look something like:

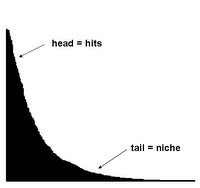

Now – draw the same graph for Amazon. By definition, the rough shape will be the same – there will be a tall “head” of hits on the left, and a shorter “tail” of niche titles on the right. However, Amazon has a much bigger inventory (although nowhere near as nice ambience :), and there’s reason to believe that a lot of Amazon’s sales come from books far down their best-seller list. If true, Amazon’s graph will look something like:

The central idea of the long tail is that, in today’s world, the proportions of many such curves are changing, and the tails are growing longer.

That means that the relative importance of “niche” offerings vs. “hits” is increasing. It does not mean that hits are going away, or that we’re shifting to a completely flat world where all books are equally popular. It does mean, though, that the total contribution of niches is climbing compared to the total contribution of hits.

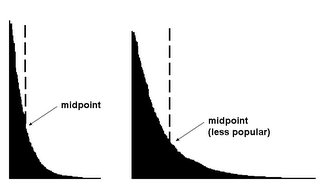

If I had hard data and wanted to quantify things, I would look at metrics like the mid-point of total sales – at what point on the curve is the area to the left (total sales of books more popular than the mid-point) equal to the area to the right (total sales of books less popular than the mid-point). In a short-tail world, that mid-point is pretty far to the left, and therefore represents a fairly popular offering. In a long-tail world, that mid-point has shifted to the right, and therefore represents a less popular offering.

So what’s going on here?

Is this just about books? No. The dynamic of a weight-shift from hits toward niches applies across many industries and domains, including:

- Television channels. Not that long ago, most markets had much less than the 10 or so possible VHF stations. Then UHF added the potential of a couple of dozen stations. Now cable makes it’s easy to have hundreds of choices.

- Movies. Old movie theaters were designed to give large audiences the choice of one or two films. Then they started sub-dividing those big rooms. Now a dozen or so screens is normal, and only occasionally on the release of big hits do they show the same title on more than one screen.

- News. The authoritative voice of the news used to be a network anchor (you had a choice of two or three) your local paper, and one of a handful of national/global papers. Now, not only have the number of network anchors and easily-accessed newspapers / newsfeeds proliferated, the entire MSM (“mainstream media”) has had the long tail of the blogosphere appended.

- Cars. We’ve come a long way from Henry Ford’s one model available in “any color you want, as long as it’s black”.

Are long tails good?

In my opinion - yes. Transactions happen when a buyer values something more highly than a seller, and when there’s an opportunity for the buyer and seller to connect. Transactions create value, because both parties are happier with what they get than what they give. (Otherwise they wouldn’t choose to consummate the transaction.) In economics, that's called the transaction surplus, and negotiating prices is all about deciding how to split the surplus between the buyer and the seller. In all cases, though, value has been created by the swap.

In a long-tail world, buyers have more choices. Instead of being limited to a few best-sellers, they can and do pick some newly available niche items. Therefore, they are choosing things they value more, which creates more value than was possible in a short-tail world.

Note that not all transactions are as directly financial as buying a book – I might be exchanging my time, my attention, and/or my money for your words, your ideas, and/or your stuff. The dynamics are the same, though – now that it’s cheaper and easier for us to choose between many ways to meet our needs, it’s more likely that some of us will make less popular choices, and our collective weight will shift from hits towards niches.

- dG

No comments:

Post a Comment